does instacart take taxes out of paycheck

Then you will enter your expenses. To actually file your Instacart taxes youll need the right tax form.

The Ultimate Guide To Self Employed Taxes Everlance

This includes self-employment taxes and income taxes.

. Instacart shoppers are paid a minimum amount for every batch or order they complete. To pay your taxes youll generally need to make quarterly tax payments estimated taxes. There will be a clear indication.

Youll include the taxes on your Form 1040 due on April 15th. Knowing how much to pay is just the first step. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

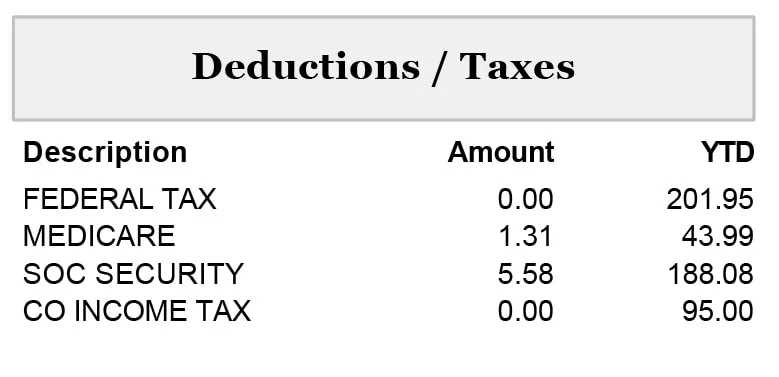

This amount was previously 3 but after a PR snafu when. Please make any changes by January 15 and reach out to. If you pay attention you might have noticed they dont take that much out of your paycheck.

Instacart delivery starts at 399 for same-day orders over 35. For most Shipt and Instacart shoppers you get a. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

This calculator will have you do this. Plan ahead to avoid. If you do Instacart for extra cash and have a W-2 job you have the option to increase.

Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Instacart shoppers typically file personal tax returns by April 15th for the income you earned from January 1st to December 31st the prior year.

Answer 1 of 4. Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment.

Everyone out there serving for. Instacart does not take out taxes for independent contractors. The Instacart 1099 tax forms youll need to file.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. Does Instacart take out taxes for its employees. Minimum Batch Payment.

Download the Instacart app or start shopping online now with Instacart to get. Does Instacart take taxes out. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. Part-time employees sign an. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

Youll include the taxes on your. The Instacart 1099 tax forms youll need to file. June 5 2019 247 PM.

What Taxes Do Instacart Shoppers Need to Pay. Instacart does not take out taxes for independent contractors.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Visualizing Taxes Deducted From Your Paycheck In Every State

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Delivery Drivers For Instacart Postmates And Others Say Algorithms Are Destabilizing Their Pay The Washington Post

Instacart Driver Review 10k As A Part Time Instacart Shopper

What You Need To Know About Instacart 1099 Taxes

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

Instacart Rewards Shoppers With Gas Discounts Caregiving Perks Nacs

Explaining Paychecks To Your Employees

2021 Tax Guide For Grubhub Doordash Uber Eats Instacart Contractors

Instacart Pay Stub How To Get One Other Common Faqs

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

Taxes 2020 Coronavirus Will Screw Up Your Taxes Next Year Money

How To Do Taxes For Doordash Drivers 2020 Youtube

Is It Possible For A Weekly Salary Of 500 To Have Over 100 Of Taxes Taken From Each Paycheck Quora

40 An Hour Is How Much A Year Savoteur